The EV-olution of

Managing your fleet of company vehicles

is now easier than ever.

Managing one or two company vehicles is pretty straightforward. It’s usually an admin task that can be completed without impacting somebody’s day too much. But once you reach upwards of 15 vehicles then it’s a task that needs more resources. With more vehicles comes increased risk, increased admin and increased costs.

The Challenges of Managing a Company Car Fleet

Managing the company vehicle fleet sounds like a simple task. But, unfortunately, many companies think it can’t be more than just ensuring all vehicles are taxed, insured, and have an up-to-date MOT certificate. That’s why it’s often dropped on an HR or admin person’s desk to sort out. Sound familiar?

The Truth is Very Different

The compliance side of operating company cars is massive and includes a vast array of elements to control:

- Vehicle Renewals

- Telematics

- Breakdowns

- Vehicle Checks

- Driving Licence Checks

- MOTs

- Taxation

- Servicing and Maintenance

- Supplier Management

- Insurance and more…

The Solution

So, how does a company manage all those moving parts? We call it our Partner Program, by becoming a Partner you will have access to:

Vehicle Replacement Programme (VRP)

The VRP sits at the core of our Partner Programme and covers every element of your vehicle fleet requirements for the future.

Bandings & Gradings

We start by working with you to set clear vehicle bandings and gradings for your drivers. For example, directors can select from one particular group of vehicles, sales execs from another, and managers from another. Within these bands, we will agree on the general specifications for the vehicles, such as fuel types and permitted options.

Whole Life Costs

Our experts will then calculate the Whole Life Costs for each type of vehicle, so you’ll have a complete view of all the recurring costs involved and the driver will understand their tax implications (BiK).

Multi-Funder Finance and Leasing

Funding business vehicles is a complex topic. With multiple funding products and a raft of lenders to approach, it’s almost impossible for companies to make an informed choice. Ultimately, there is no one-size-fits-all method to fund all your vehicles, and we usually find that companies need a blend of the following products to give them the best outcome:

Contract Hire

You rent the vehicle for a fixed term and monthly cost.

Hire/Lease Purchase

You purchase the vehicle with an initial deposit and a 3rd-party loan.

Contract Purchase

Similar to a contract hire but with the option to purchase at the end.

Finance Lease

Like contract hire, but the repayments can be structured with a low monthly payment and a balloon payment at the end.

Outright Purchase

You use your cash reserves to buy the vehicle outright.

We will advise you on the best options and tailor a bespoke funding package for your business.

How Does It Work?

Quite simply, we do practically everything for you. And we simplify the bits you have to do.

For example, when it’s time to renew your vehicles, your relationship manager will refer to the VRP and contact the drivers individually. Once we’ve organised the replacement vehicle, all you have to do is sign it off. However, you can have as much control and involvement in the process as you like.

Support & Training

If your driver decides to go for an electric vehicle, we can give them all the training they need to transition to this different form of driving.

Day-to-day Management.

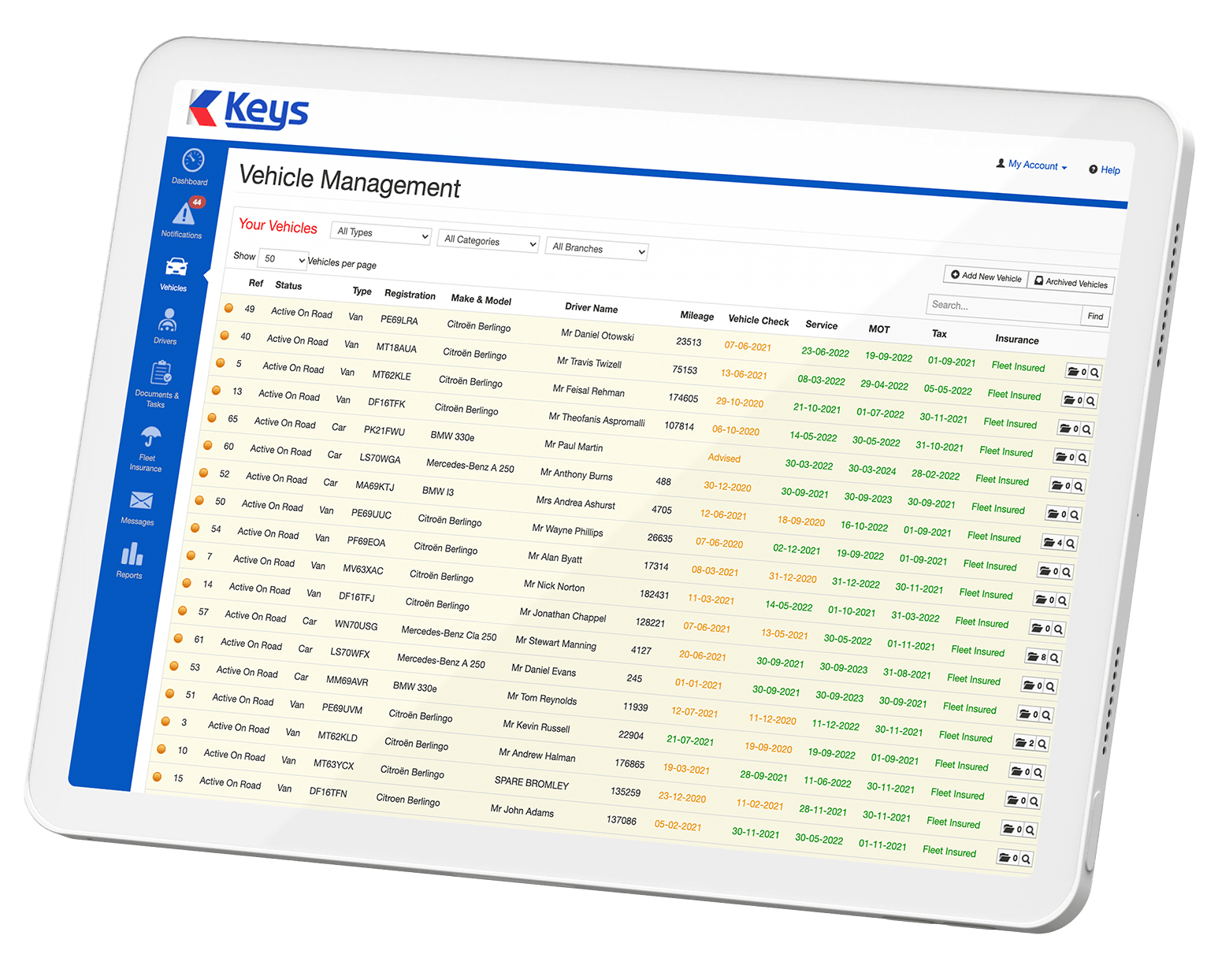

As for the day-to-day management of your fleet, we give you our bespoke fleet management software called Keys.

Keys is the driving force behind all your fleet management operations. You can store and access comprehensive information about vehicles, drivers, insurance policies and everything else. Plus, it takes care of tracking expirations, maintenance tasks, license checks… basically anything you need to stay on top of to keep things running smoothly. All your legal compliance is covered by one piece of software rather than fragmented onto multiple spreadsheets on different computers. Talk about efficiency!

Additional Services

In addition, you’ll also get our accident management service. So if one of your drivers should have an accident while out and about, all they need to do is call one phone number, and our accident management specialist will deal with everything, including getting them back to base.

We also offer a range of services from PAYGO, providing breakdown cover, vehicle maintenance programmes, and windscreen cover.

For all enquiries, please get in touch.

Contact Us Today

If your enquiry is for 15+ vehicles, then please complete this form and one of our fleet team will be in touch!

"*" indicates required fields